AMM is an important component in the DeFi market that makes it possible for investors to transact directly through smart contracts (decentralized exchanges) and limit interference from 3rd party organizations. AMM relies on providing liquidity from users in exchange for rewards and transaction fees.

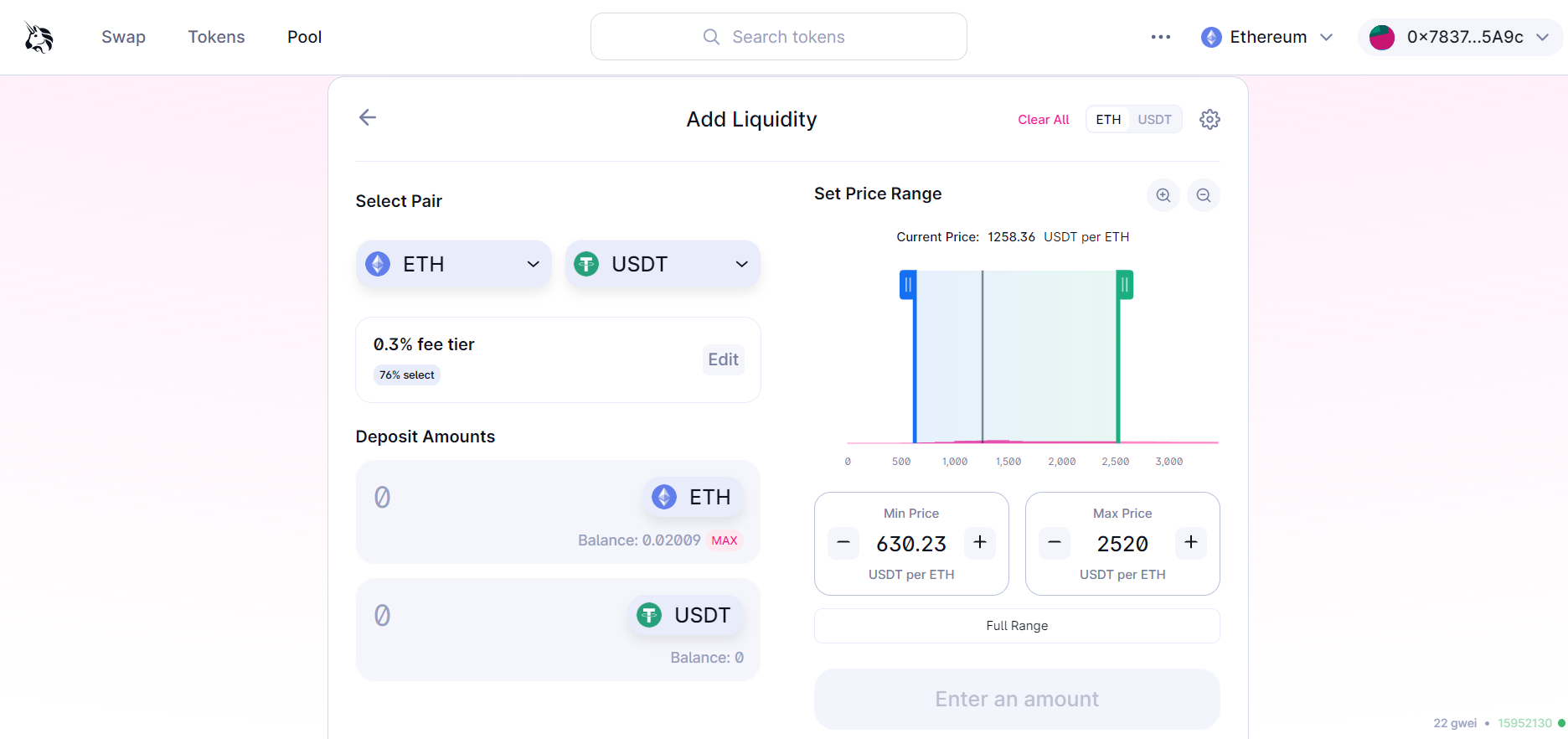

With the launch of Uniswap V3, many capital optimization features were developed such as liquidity concentration through supply zone adjustment. However, these improvements are still creating cumbersome and complicated operations when liquidity providers need to consider calculating the price range, fees to be received, temporary losses,... ⇒ difficult to achieve . widely used and time consuming. And Gamma Strategies is the platform that helps simplify this problem for users.

What are Gamma Strategies?

Active liquidity management (ALM) is a strategy adopted by Gamma Strategies to adjust liquidity parameters on behalf of liquidity providers. Gamma Strategies smart contract automatically adjusts price bracket, balance sheet and reinvests fees received to optimize profits.

Mechanism of action

Gamma Strategies builds on the Uniswap - Hypervisor position management contract, integrating many features enabled by the active management contract - Supervisor.

- Hypervisor - performs position framing operations, collects and reinvests fees received on behalf of users.

- Supervisor - implement asset management strategy for Hypervisor.

One of the challenges with providing liquidity on some AMMs like Uniswap is the mandatory 50/50 ratio for a pair of 2 tokens. Through Hypervisor, users can deposit without exactly 50/50, Hypervisor will allocate in accordance with the pool ratio and limit the position of the remaining assets.

The user who provides liquidity through Gamma Strategies performs the first operation, then the parameter adjustment will be handled by the platform towards optimal profit, and the liquidity provider receives 1 NFT representing the stock. their ownership in the pool. When withdrawing liquidity, this NFT will be burned.

Solutions for business

In addition, Gamma also develops features including liquidity mining, sustainable treasury and liquidity co-management to support DAO and .

- Liquidity Mining ⇒ increases capital efficiency when the same amount of liquidity provides less capital.

- Sustainable Treasury - each project often organizes programs to promote liquidity on the platform and this treasury is extracted from the profits generated instead of native tokens or stablecoins. And Gamma will help these projects generate passive income from assets that can then be reallocated to contributors.

⇒ Thus, the Gamma Strategies customer file includes both individual investors and businesses and the solution provision (infrastructure) will serve a variety of fields (liquidity is an important factor in any DeFi platform e.g. lending array, trading platform, etc.).

Some project information

The team is anonymous, but according to the disclosure, the product developer team includes former MakerDAO members and a number of other figures with backgrounds in many fields such as traditional finance, legal or data science.

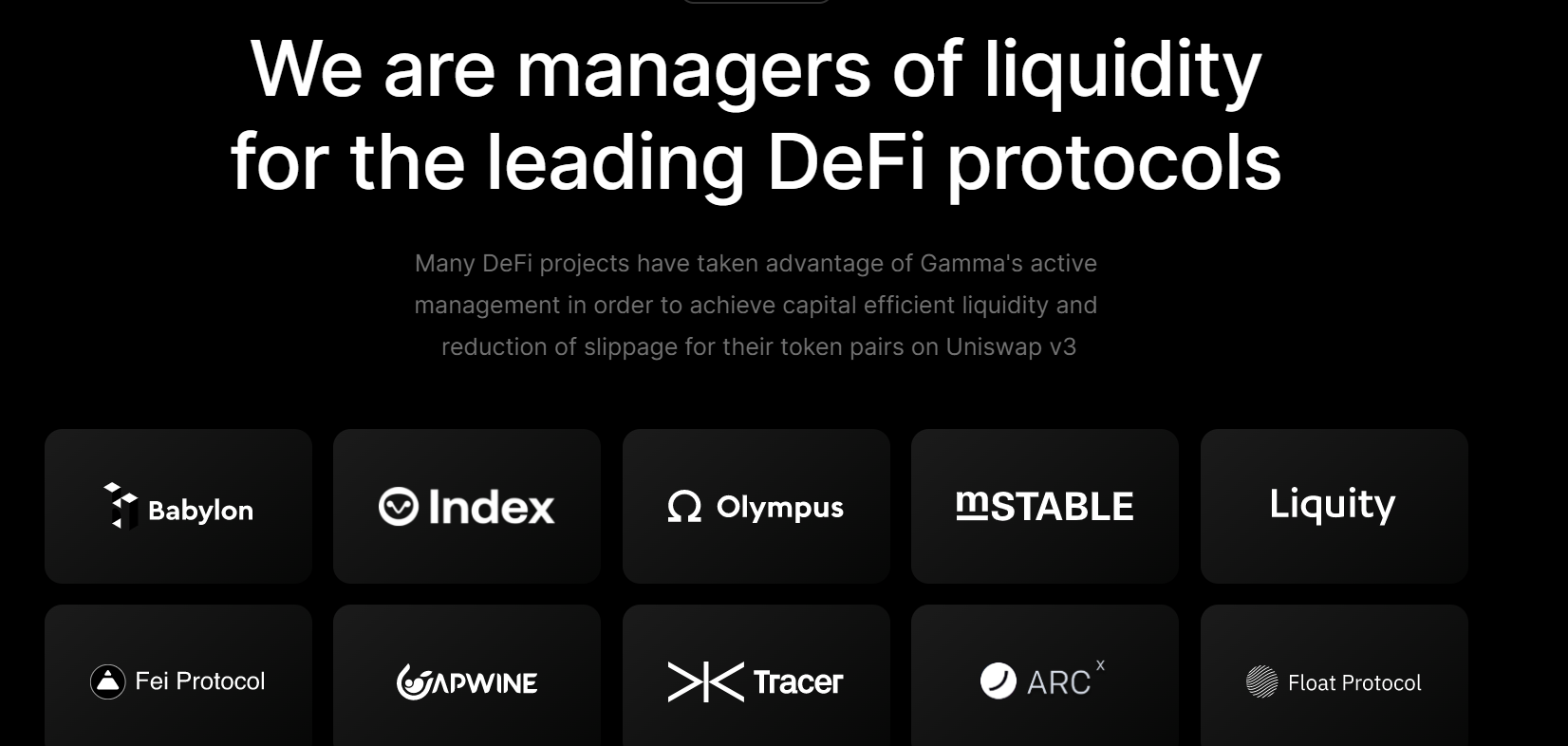

Currently Gamma Strategies is managing liquidity for Olympus, Liquity, Tracer, Fei Protocol, ARC,... and partnering with Frax Finance, Angle, Ribbon, Llama, Tokemak, Perpetual Protocol,... Significant until recently including the combination with Rocket Pool (Read more about Rocket Pool HERE) to develop a liquidity farming program on Uniswap v3, this combination has attracted a large amount of liquidity. to a liquidity of 750,000 USD after only 2 days of launch. Besides, Gamma Strategies also mentioned that the project is in the process of integrating with Quickswap.

1/ @Rocket_Pool Liquidity Mining program garners $750K in liquidity after just two days of launch.

— Gamma (@GammaStrategies) November 11, 2022

1) Pair: rETH-WETH on Uniswap v3

2) Current APR: 18.1%

3) Network: Ethereum Mainnet

4) Guide: https://t.co/nVpZCjViSD

5) Webapp: https://t.co/duZiNdMz6j

The project has been audited by Consensys Diligence and Arbitrary Execution , so the authenticity of the smart contract can be guaranteed. Gamma Strategies is rolling out on Polygon, Optimism, Celo,... and soon to expand to Arbitrum ⇒ news that could impact prices in the short term as Arbitrum is attracting cash flow.

Identify $GAMMA . Token investment opportunities

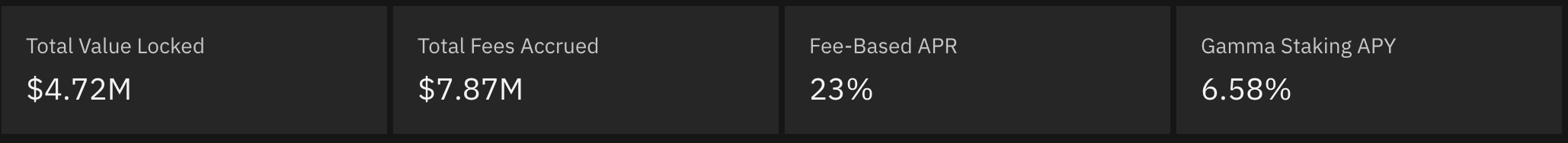

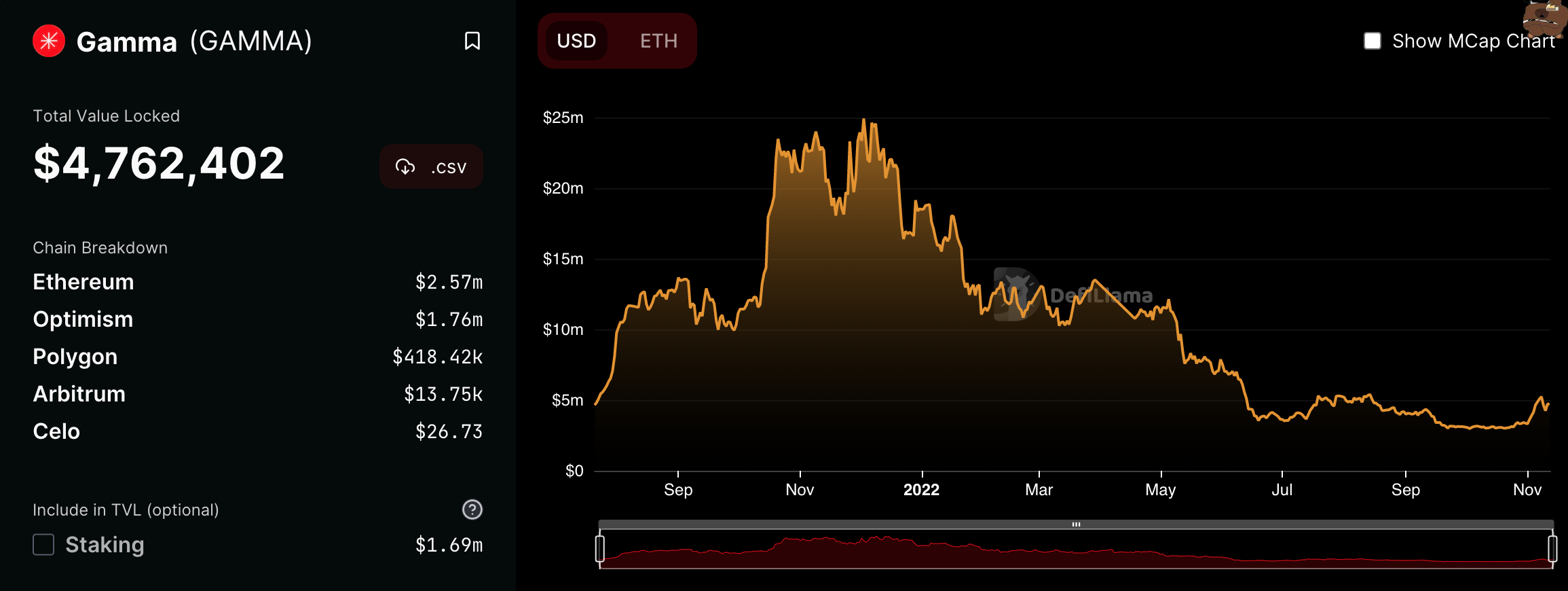

As of press time, the price of the $GAMMA token is trading at around $0.08, divided by 10 ATH prices in November 2021. The current project's market capitalization is around $2.5 million. However, TVL and the amount of fees generated by the project are much higher than the market cap.

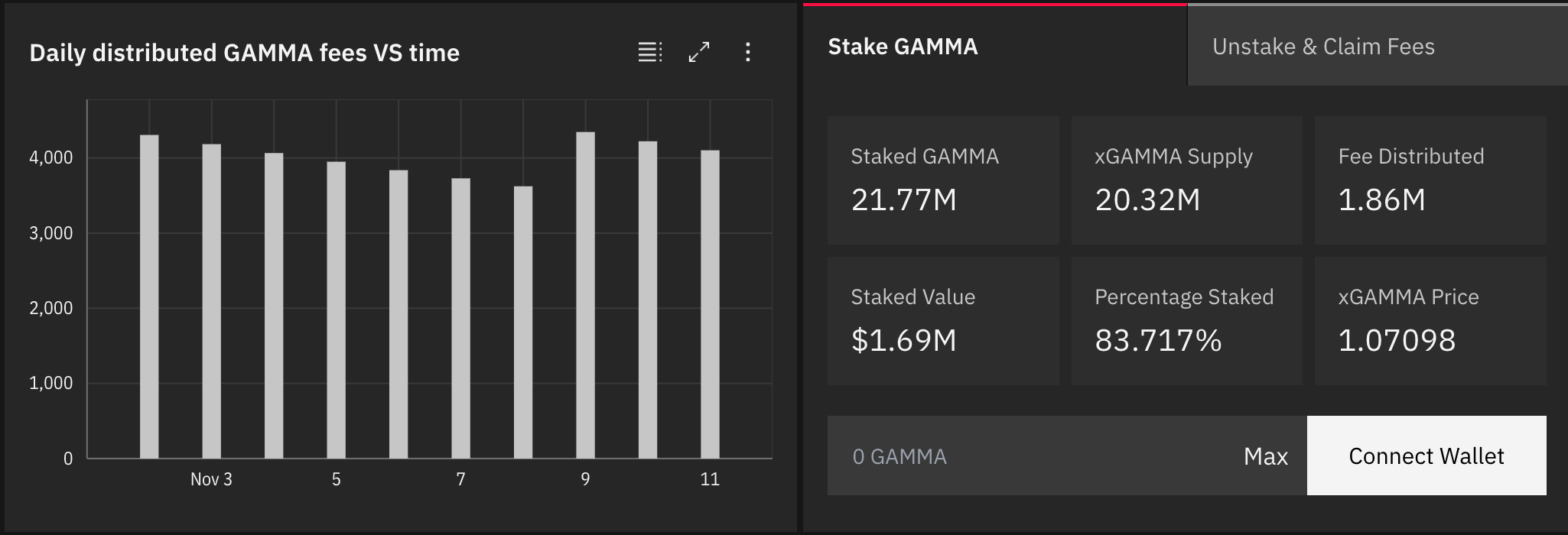

Gamma Strategies is a project that uses Real Yield mechanism (Read more about Real Yield HERE), and uses the fees generated from the project to redistribute it to GAMMA stakers on project. This attracts a large number of users staking GAMMA, with a stake of GAMMA amounting to 83.717% of the total tokens in circulation.

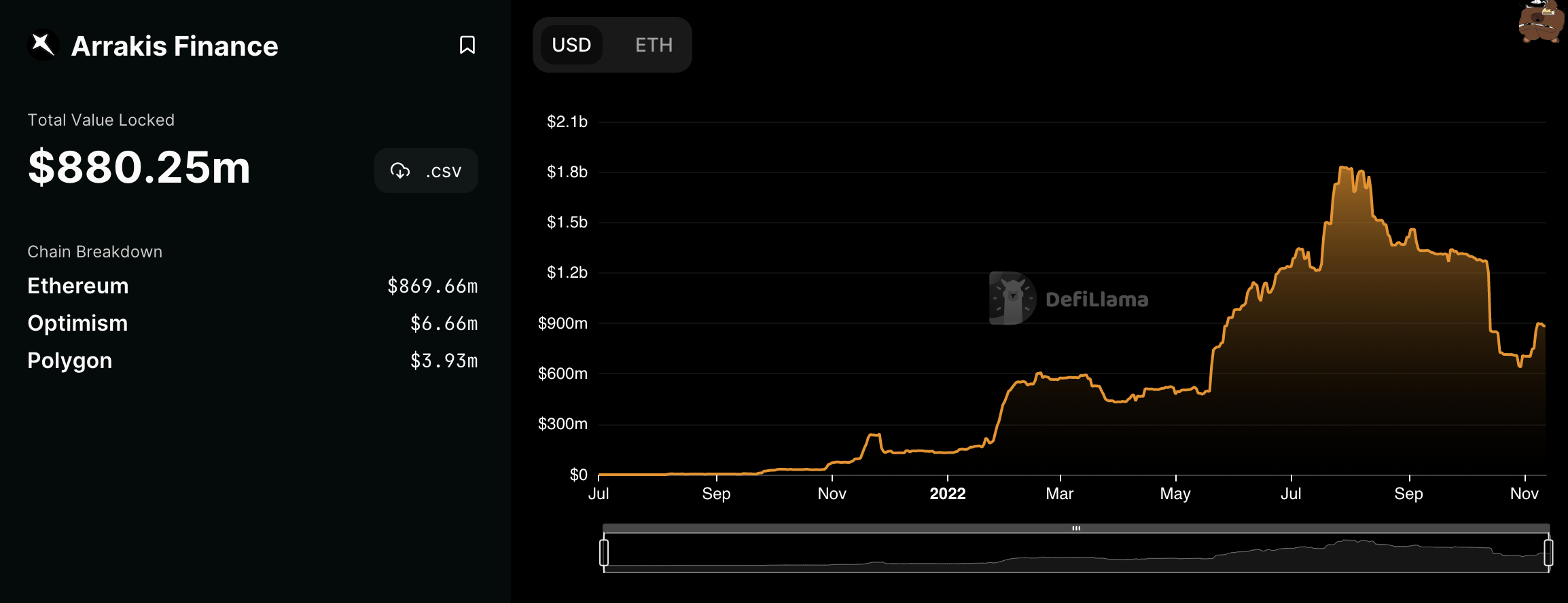

The current total value of locked assets (TVL) of Gamma Strategies is around 5 million USD from time to time. Meanwhile, a major competitor directly competing with Gamma in the same field in which the project operates is Arrakis Finance, which has a TVL of over $800 million (with a peak of $1.8 billion). This shows that Gamma still has space and potential for development.

Around the end of October and the beginning of November, after a period of bottom formation, the project's TVL, trading volume and price showed clear signs of increasing. However, the FTX "black swan" event took place, the crypto market fluctuated strongly and caused the price of GAMMA to split by 2 again, but the project's TVL did not seem to have much impact.

According to the writer's personal opinion, Gamma Strategies is still doing its job well, and continues to expand while receiving support and cooperation from many parties. With a small cap and low token price, investors can completely consider buying into the "lottery" when the market has recovered and started to stabilize.

Instructions for trading Gamma tokens on Holdstation wallet

Step 1: Switch to the Ethereum network and click on the swap icon below the screen.

Step 2: Select the token you want to convert to and enter the name Gamma in the Target Token field (the green tick token has been verified by the Holdstation wallet).

Step 3: Enter the amount you want to swap and confirm.

- Download Holdstation wallet HERE (Currently Beta Testing version for iOS operating system, please download TEST FLIGHT first. Holdstation wallet will be available on Android soon).