Recently, after the bankruptcy of FTX, GMX emerged as one of the alternatives to centralized exchanges, considered one of the decentralized exchanges with great potential. There are many projects built on GMX. However, GMD is one of the fastest-growing protocols.

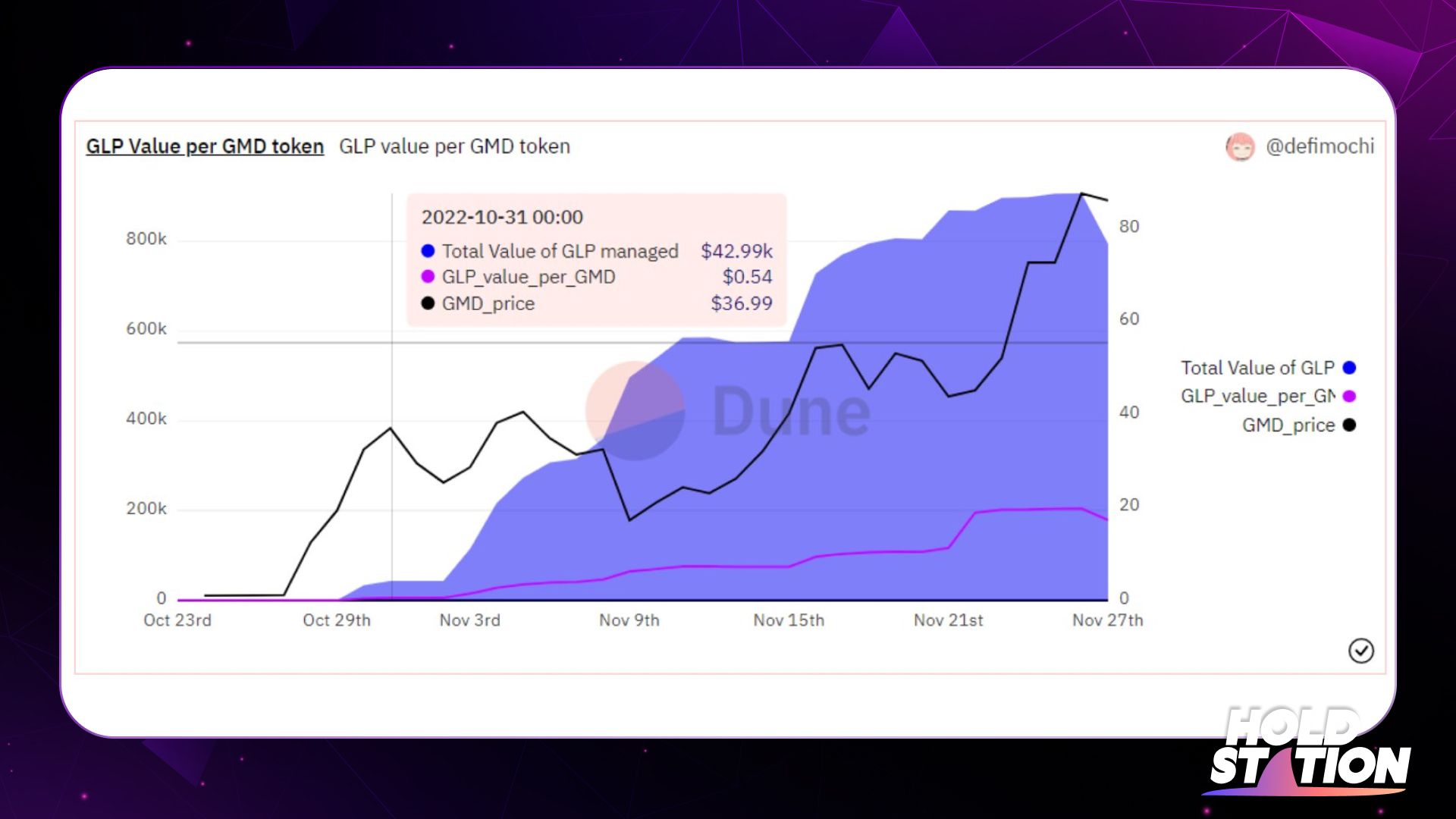

In just 1 month, GMD's capitalization has increased 20 times, from $300,720 to $6,320,000, by the end of November. How can this project compete with other opponents, also built on GMX?

Overview

The GMD protocol is a protocol built on top of GMX, with a function that allows USDC, ETH, or BTC to be staked to receive an annual interest rate (APR). This protocol will help to ensure the interest of the staking process from pre-determined assets, avoid Impermanent Loss, and reduce exposure to unwanted assets.

GMD is also the first protocol to introduce a "pseudo-delta-neutral" (pseudo-delta-neutral) strategy.

How GMD works

GMX Payments Provisioning Token - GLP, this token price is considered as an index rather than token price since GLP, in essence, includes the ratio of ETH, BTC , UNI , LINK and stablecoins. Because it's just the combination of ratios, if the value of these tokens fluctuates, the price of GLP will also change, making it extremely hard to control.

To avoid this volatility risk, Delta's Neutral Yield strategy for GLP tokens emerged as an alternative. This is a strategy to avoid affecting the volatile price of $GLP by creating a Short position that for the pair $BTC/$ETH at the same rate as the $GLP asset. When $GLP is volatile, interest received from GMX revenue remains unaffected as 1X Short orders that combine with owned assets (can be understood as 1X Long orders) will eliminate each other in the case of fluctuations.

Read more: What is Delta-Neutral Yield?

GMD's pseudo-delta-neutral strategy works similarly. This allows users to deposit WBTC, WETH, USDC into treasury, then balance the ratios of these tokens relative to the ratio of GLP token. This protocol will simulate the operation of the GLP liquidity pool on GMX. From there, users can both benefit from the GLP token and not worry about their assets being affected by price fluctuations.

Users deposit assets and receive in return gmdUSDC, gmdETH, gmdBTC. Rates are added in real-time.

It can be seen that GMD is also contributing to the development of the GMX ecosystem with new innovations, more suitable for the risk appetite of each investor.

One thing to note, the GMD protocol has an exclusion limit in staking, which is generally beneficial for the protocol itself. However, as a liquidity provider, investors should also consider reminders to avoid unnecessary risks.

Why does the GMD protocol get attention?

Differences with GLP payments

The worst nightmare about participating in GMX's GLP liquidity pool is the fluctuation in the price of the tokens that make up the price of GLP. This is completely eliminated when using GMD with its delta-neutral strategy that ensures asset placement. At the same time, GMD token holders will receive bonuses from losing traders, thereby providing a higher return than the work of risking temporary loss.

Additional profits for users with Real Yield

According to the project's Whitepaper, for the interest paid for stakers, the GMD protocol only needs to use half of the GLP tokens obtained from the ETH stake on GMX (considered as a joint venture). persistent link) to meet the APR. The other half will be collected as a performance cost/revenue of the protocol - most of which will be redistributed to GMD token staking, returned in WETH.

Total revenue of the protocol to date: 40,756 USD

A few recent data worth noting

The total Value Locked, including GMD tokens and payments, is worth about $3.4 million. This is quite a large number compared to the market capitalization at 6 million USD ( TVL accounted for 56.6% market cap).

$GMD has a maximum total supply of 80,000 GMD tokens. This number could still increase if there occur a vote from project's community to agree with the plan (previously occurred when the total supply was 70,000 GMD )

User's APR on GMD will clearly reflected by the value of GMD (staking GMD to receive esGMD, the token that provides liquidity for the project). This is also a way to check out the project's performance, along with checking the total value of locked assets (TVL). Currently, the amount of GLP that the platform manages based on each GMD token is on an upward trend, so the profit earned by the investor is also the project's profit.

Should you invest in GMD tokens?

The GMD price is currently hovering at around $75, after a lot of strong rallies in the past week (up nearly x2 from bottom to top last week). Looking at the recent price chart of GMD token, it can be seen that the price has increased dramatically, but considering the total circulating supply of only 80,000 tokens, the market cap is only 6 million USD, a very humble number with the potential of GMX ($374 million in market capitalization), GMD still has the ability to grow strongly in the coming time. When users are flocking to decentralized exchanges, including GMX, the benefits of GMD - playing the role of liquidity provider - can not be ignored.

Summary

The above is the Holdstation's research from the GMD protocol built on GMX. Let's wait for the explosion of the Defi market in the near future when the market starts showing signs of recovery.