Introduce

PlutusDAO is a liquidity optimization and decentralized governance platform built on the Layer 2 – Arbitrum ecosystem. Fork from Convex Finance, the values brought by PlutusDAO are aimed at increasing value for Holders and liquidity providers.

So how does PlutusDAO "Maximum rewards with maximum liquidity"?

Products

Before learning more about PlutusDAO, let's take a look at the past Curve Wars. Curve Wars is a battle between platforms with the main purpose of collecting as much $CRV from the market, the key here is from users. To increase the amount of voting escrowed (Vote-Escrowed CRV or $veCRV) in Curve Finance platform. From there, you can win an overwhelming number of votes and hold most of the decision on inflation, bring the best interest rate for your LP, Pool, attract users and generate revenue.

To win this race, participating platforms must attract investors with a high enough APR that they can commit to permanently locking $CRV.

Convex Finance is the winner.

The operating model of PlutusDAO is similar to derivative products that lock forever to receive Boost APR from $PLS and platform fees. The products are plsAssets and plvAssets, but PlutusDAO's ambition is bigger as they continuously launch products such as $plsDPX, $plsJONES, $plvGLP and most recently $plsSPA.

Vault

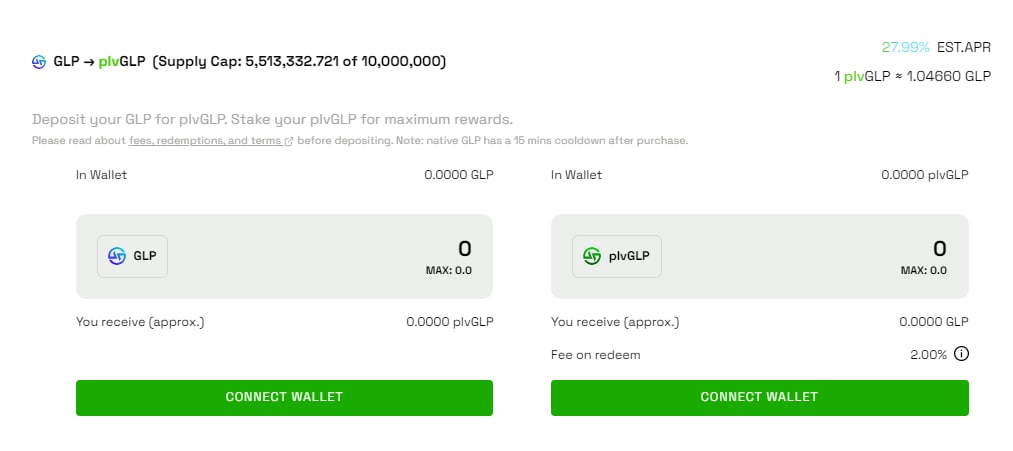

plvAssets with the only current product being $plvGLP – the liquidity token of GMX.

The operation of Vault is very simple, you just need to lock $GLP into the platform to receive $plvGLP and Stake. Here, the platform will automatically accumulate your $ETH reward and pay the additional reward in $PLS instead of $esGMX.

If you are someone who expects strong growth potential of $PLS, is committed to providing long-term liquidity for GMX and wants to sell $esGMX rewards immediately without having to wait for linear-vesting while still receiving compound interest, $plvGLP is the final destination for the amount of $GLP you are holding.

Staking Pool

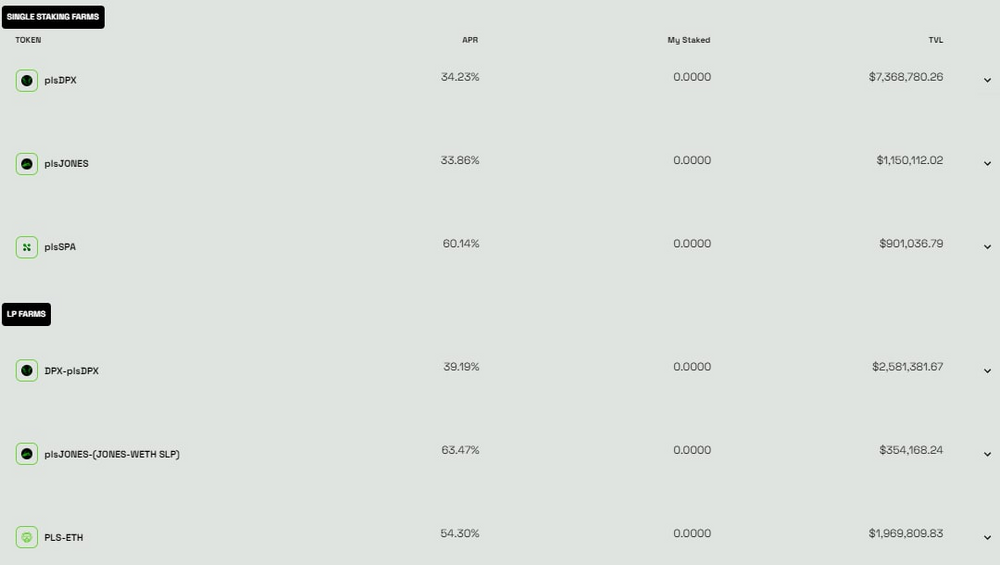

Similar to the benefits that Convex Finance offers to $CRV Holders, plsAssets allows users to:

- Get rewards equivalent to locking for maximum time

- Flexibility in swapping without any hindrance

- Get more rewards from $PLS, platform fees

- Selling/lending voting rights

The way it works allows users to permanently lock tokens supported by the platform with maximum lock time and mint out plsAssets. However, users can still "close" their positions in the secondary market.

Right! It is basically a derivative asset used in Liquid Staking such as stETH, cETH, rETH, ...

With the current products PlutusDAO is holding:

- 54.57% $veDPX

- 7.56% $veJONES

- 42.45% $veSPA

- 5.76M $GLP

Tokenomic

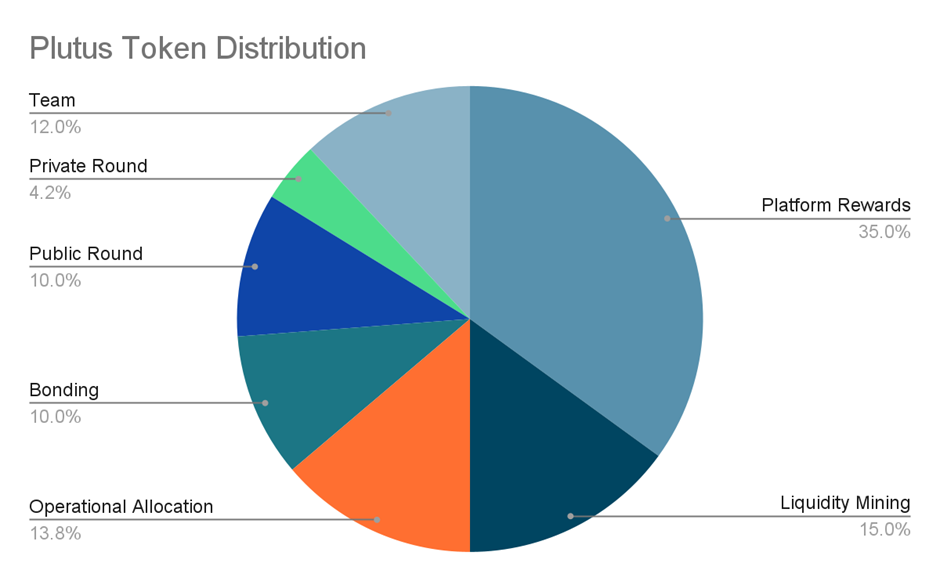

The project is implemented without any tokens for investment funds that raise funds from Private Round and Public Round from users of Dopex and JonesDAO. Currently, there are also word of mouth like these 3 platforms are the same team created to gain administrative rights as well as attract users to each other to create a new force on Arbitrum. And it's not unreasonable to go to Discord of all three platforms and see "familiar faces" operating on all three Discord channels.

📣 OVER 1,000,000 USD DONATED IN UNDER 12 HOURS.📣

— PlutusDAO (@PlutusDAO_io) April 29, 2022

Wow. 👏

Over three days to go. ⚡️⏱

Peep that leaderboard, we've been spying some familiar Dopex ecosystem figures in there... 👀👇 pic.twitter.com/WkICYEwg1s

Points to Note About Tokenomic

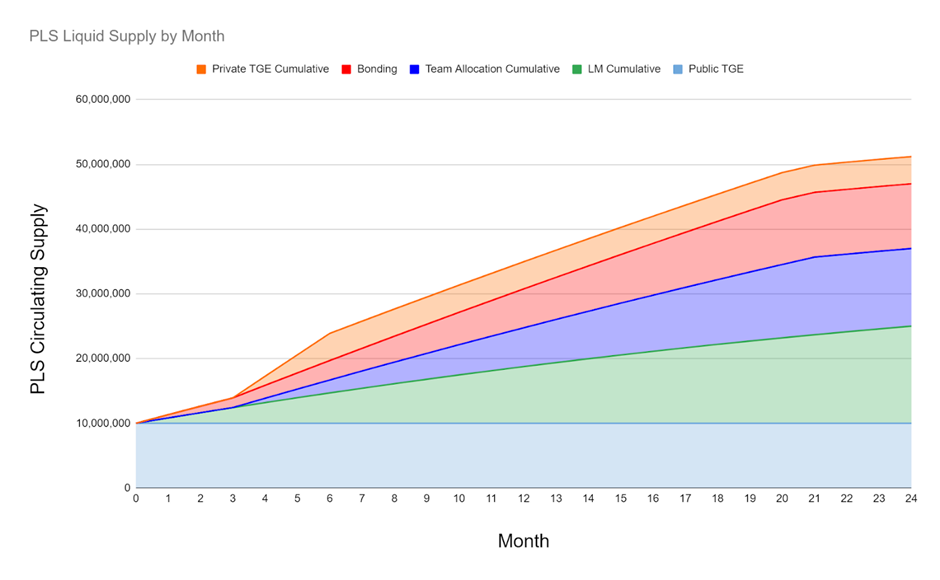

- Starting from the 3rd month (8/2022) $PLS token has high inflation until the 6th month (11/2022), the inflation rate will increase gradually until the 21st month (2/2024), the inflation rate will increase gradually. will not be as high as before.

- Public Round has been paid 100% in TGE

- Up to now, the amount of tokens in circulation is about 20.3M $PLS (about 20% of the total supply).

- The amount of tokens for Non Rebase Bonding (10%) will not be released to the market unless necessary to develop the project after the supply is reached (90M $PLS).

Current Features of $PLS

Lock $PLS to get rewarded with $plsDPX and $plsJONES with APR milestones:

- 1 month: 5.571%

- 3 months: 16.3%

- 6 months: 78.129%

However, the 1 month epoch is finally closed and the 6 month epoch will be unlocked around early November. These Stake Pools will then be replaced with another form when the project deploys Tokenomic V2.

The Future Potential Of PlutusDAO

Marketcap/Total Value Lock

The market capitalization of $PLS is hovering at $9.24M with the total lock on the platform at $22.85M at press time. So the MC/TVL index equals 0.404, indicating that the project is in good health and is operating stably, but the value is being valued by the market lower than what has been and is being done.

Promotion

Currently, if you swap $DPX to $plsDPX at Sushi Swap, you will receive a discount of about 5.2% and with plsJONES it is 20% compared to directly locking into the Convert Pool at Plutus. This will make users more interested in using Staking Pools on this platform to attract the platform's TVL in the future.

Tokenomic 2.0

This is the key to the upcoming growth potential of PlutusDAO announced at the end of October.

A 🧵 summarizing the key points of our game-changing tokenomics 2.0 upgrade for the $PLS token.

— PlutusDAO (@PlutusDAO_io) October 29, 2022

In this thread we'll summarize the new features, changes and implications of the upgrade, which is already looming on the horizon... 👀

Let's explore. 👇🟩 pic.twitter.com/oGwVp02yeB

Tokenomic 2.0 is divided into two parts. Part 1 is a reduction in the inflation of $PLS in Pools and part 2 has just been announced recently with the reveal of the combined model of Convex Finance's Bribe and GMX's Multiplier Point/esAssets.

- Users can Lock $PLS or PLS-ETH LP for 16 weeks to get $lPLS in which PLS-ETH LP will get 10% higher APR than just locking $PLS

- $lPLS will receive reward from bribe, Plutus Multiplier Point (PMP) and $esPLS

- Users with $lPLS will receive PMP at a rate equivalent to 50% of APR, when withdrawing $PLS from the Pool, the PMP will disappear. This will incentivize users to lock up their $PLS for a long time, commit to the platform and get rewarded in return.

- $esPLS is PlutusDAO's incentive reward however this will be harvested linearly over a year, if users want to start harvesting they have to re-lock their $lPLS.

In addition, owning a lot of $lPLS will also contribute to Boost APR of Pools in the platform. APR increases proportionally to the amount of $lPLS held with a maximum of 2.5 times, this will not cause $PLS inflation but quite the opposite. - As can be seen, the more rewards users want in the future, the more users are required to lock up more $PLS, which greatly reduces the circulating supply. And the inflation bonus from $lPLS applies the $esAssets mechanism, causing the selling pressure to be dispersed over time.

It is expected that Tokenomic 2.0 will be released in the near future, when the $PLS Staking Pools are completed.

Partner Projects

With tokenomic 2.0, PlutusDAO will attract users, especially platforms that will actively collect $PLS for their own benefits. Projects that have collaborated with PlutusDAO include:

- GMX (plvGLP and next will be $plsGMX?)

GMX will launch soon a derivative of $GMX, promising that PlutusDAO will "put a foot" in the battle for the governance of the platform that accounts for 40% of TVL Dominace on the Arbitrum ecosystem.

- JonesDAO ($plsJONES)

JonesDAO has been a partner with PlutusDAO for quite some time. However, the project will launch $veJONES in the near future with a product in association with Aura Finance, $jAURA.

- Dopex ($plsDPX)

Currently, PlutusDAO holds more than 50% of $veDPX, so the right to manage this "Bluechip Option" project is not too much to say belongs to PlutusDAO

- Sperax ($plsSPA)

Similar to Dopex, PlutusDAO also holds 42% of $veSPA. But on 6/11/2022 there will be SPA-plsSPA Liquidity Pool. It's possible that many people will be out of position so we can't say anything yet

- Lodestar Finance ($plsLODE?)

This is a lending platform with collateral for derivatives such as plsAsset, plvAssets, jAssets. However, the platform just went through this November 2nd token sale so we still need to watch for the next move. The launch of this platform is a good signal for PlutusDAO's derivative tokens when creating more features for the token, increasing demand, pushing the ratio to close to 1:1.

- Kornukopia (...)

The platform has no specifics yet, but we should put it on our watchlist.

- Hidden Hand (Bribe)

This is the main product of the Redacted Cartel, with the launch of tokenomic 2.0 the combination with Hidden Hand will increase the functionality along with the "Leverage Bribe" increasing the benefits for $lPLS Holders.

Summary

Above is a summary of the PlutusDAO project with information collected from many sources. Hope to bring value to your investment decisions as the Arbitrum Season approaches.

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect losses arising from the use of this article content.