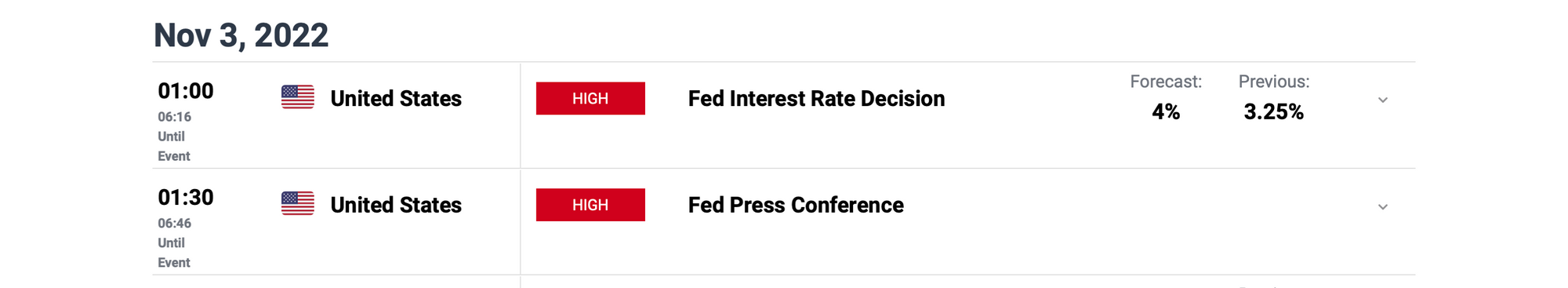

After the November FOMC is the Fed's decision to raise interest rates at 1:00 am on November 3, 2022, after the FOMC meeting ends. That is a significant event and directly impacts the world economy because the Fed continuously raises interest rates to fight inflation and strengthen the dollar (DXY) in the face of the global economic downturn worldwide.

The Federal Fund Rate

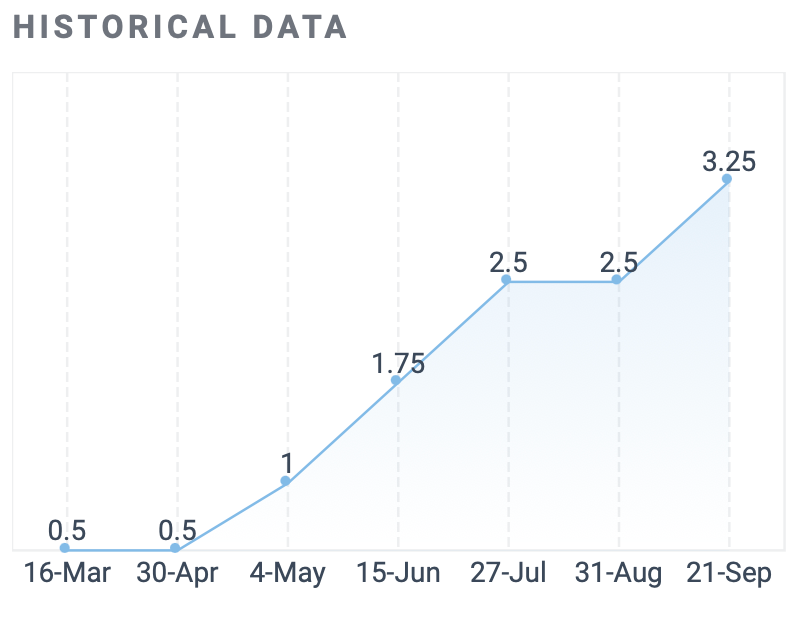

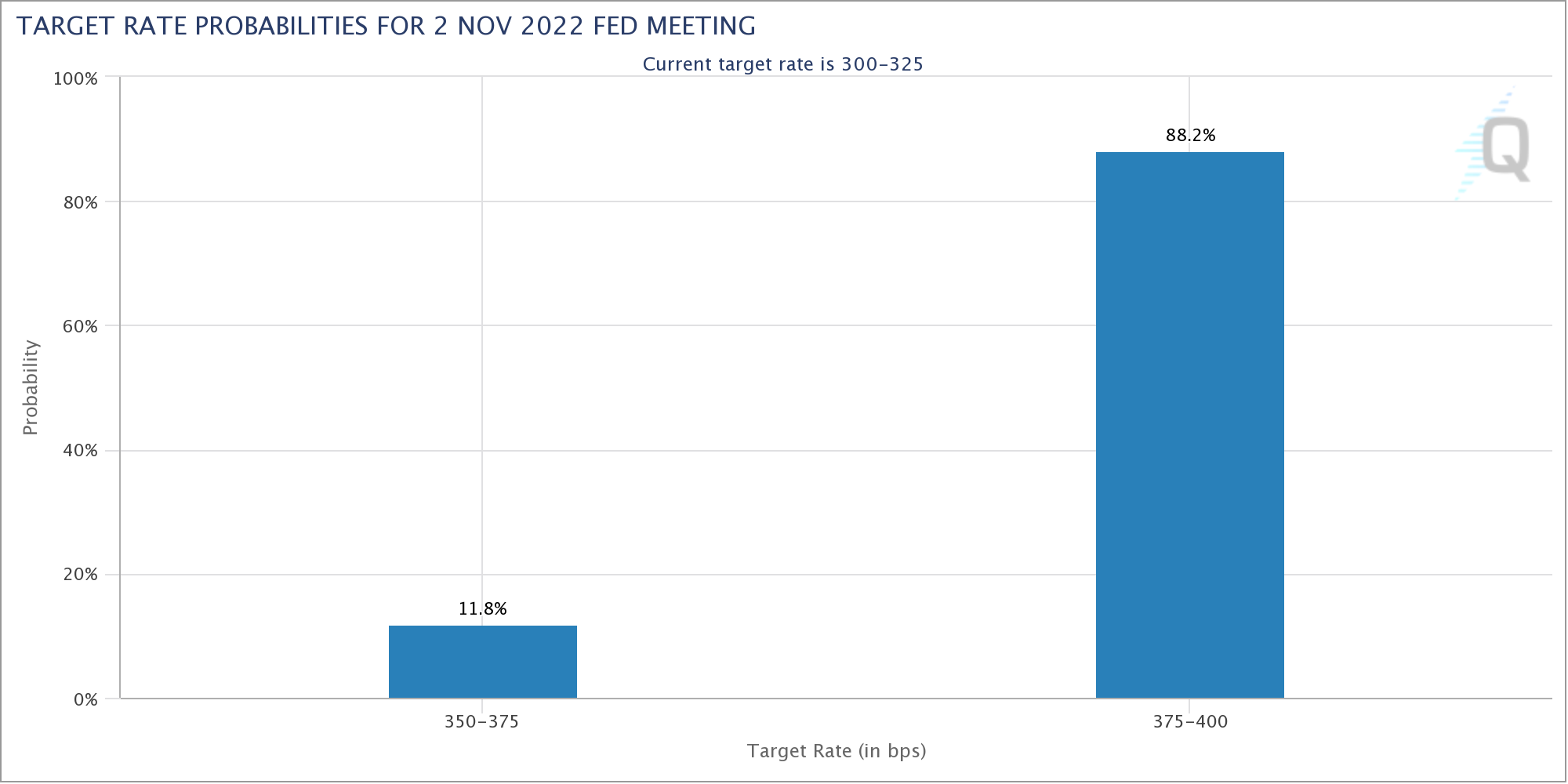

The Fed's decision to raise interest rates in November is predicted to increase by 0.75% or, in other words, a 75 basis-point increase from which interest rates will be in the range of 3.75% - 4%, which is also the highest interest rate since 2008. after the Central Bank tightened its monetary policy in 1980. Top banks worldwide also predicted an increase of 75 basis-point, such as Bank of America, Barclays, Citigroup, JPMorgan Chase, etc.

In case the Fed raises interest rates in line with market expectations of 0.75%, the DXY index will increase, but it is expected that the price of Bitcoin (BTC) will not crash because the whole market is prepared for this rate increase. Fed and interest rates are at an "acceptable" level according to the inflation reduction plan proposed by the Fed. Besides the prediction that BTC will not crash, there will be a significant recovery when the market is ready for a Fed rate hike.

Fed Press Conference

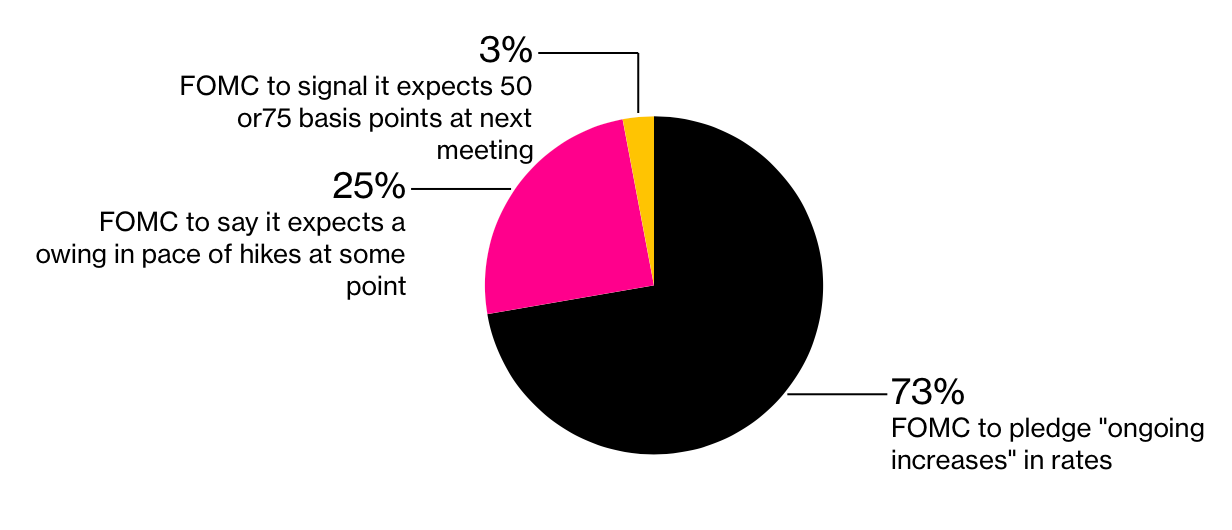

After the Fed announces the interest rate, there will be a press conference of the Fed 30 minutes later on the policy of curbing inflation through the current interest rate increase from March 2022. Based on a Bloomberg survey at the end of October shows that the FOMC will continue to raise interest rates as in the past time at a rate of 73%, followed by catching up with a robust rate increase at some point at a rate of 25% and finally only 3 % of FOMC members are expected to increase by 50-75 basis-point by December FOMC.

Summary

The crypto market is currently facing much volatility from both the macroeconomics and the Fed's response to the economic downturn. Therefore, investors need to be careful with investment decisions at this stage with the "bull market." Finally, investors need to prepare psychologically for all possible cases when the Fed announces interest rates at dawn on November 3 as well as on the FOMC in December.

Disclaimer:

The information, statements and conjecture contained in this article, including opinions expressed, are based on information sources that Holdstation believes those are reliable. The opinions expressed in this article are personal opinions expressed after careful consideration and based on the best information we have at the writing's time. This article is not and should not be explained as an offer or solicitation to buy/sell any tokens/NFTs.

Holdstation is not responsible for any direct or indirect damages arising from the use of this article content.

Source: Bloomberg, DailyFX and CME Group